Tax laptop depreciation calculator

Choose Property Type Construction Type Quality of Finish Estimated Year of Construction Estimated Floor Area Year of Purchase State then. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation.

Download Depreciation Calculator Excel Template Exceldatapro

Historical Investment Calculator update to 15 indices through Dec.

. How to use the Tax Depreciation Calculator. If you used the computer for more than 50 business use you can either. D i C R i.

Mobileportable computers including laptop s tablets 2 years. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë.

And if you want to calculate the depreciation youll also need to know the. If you occasionally use your mobile phone for work purposes and the total deduction youre claiming for the year is less than 50 you can claim the following flat rate amounts. Depreciation Calculators Tax Calculations.

ATO Depreciation Rates 2021. Business use percentage if less than 100 depreciation method you want to use. The MACRS Depreciation Calculator uses the following basic formula.

Discover Helpful Information And Resources On Taxes From AARP. C is the original purchase price or basis of an asset. For eg if an asset.

Please resend the purchase document of the laptop along with the letter from the company stating that you use the laptop 100 for work purposes when sending the calculation. Cost or adjusted tax value. Before you use this tool.

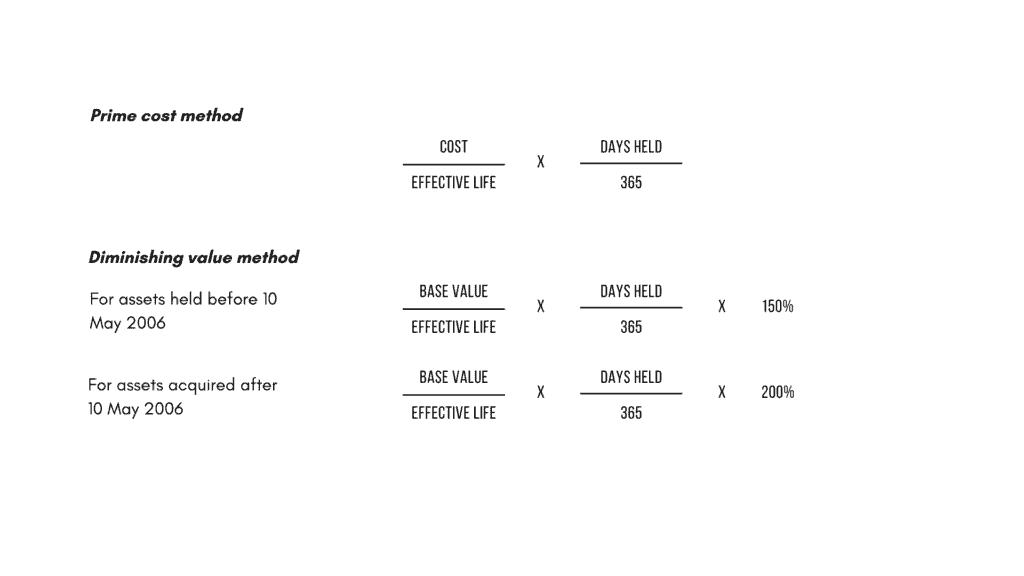

The four most widely used depreciation formulaes are as listed below. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method.

Use the modified accelerated cost recovery. How to use the Tax Depreciation Calculator. Where Di is the depreciation in year i.

Compare different assets for example the SP 500. Straight Line Depreciation Method. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Depreciation can be claimed at lower rate as per income tax act. The tool includes updates to. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Calculate your tax refund and file your federal taxes for free. Depreciation asset cost salvage value useful life of asset. You can claim a one off tax deduction if the cost of the computer laptop or tablet was less than 300.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. The calculation methods used include. 264 hours 52 cents 13728.

Calculate the annual depreciation Ali should book for 5 years. See What Credits and Deductions Apply to You. Ad Enter Your Tax Information.

Depreciation Calculator as per Companies Act 2013. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS. This depreciation calculator will determine the actual cash value.

Computers and computer equipment are considered listed property. This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks. If it is under 300 or if any of the software you used was under 300 you.

TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. While all the effort has been made to make this.

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation

Working From Home During Covid 19 Tax Deductions Guided Investor

Download Depreciation Calculator Excel Template Exceldatapro

Straight Line Depreciation Calculator For Determining Asset Value

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

Dep Rate Chart Depreciation Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Youtube

Depreciation Formula Calculate Depreciation Expense

Asset Depreciation Getting The Most Back On Your Tax Return

What Is The Highest Rate Of Depreciation Under Income Tax And For What Items Quora

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator With Formula Nerd Counter

Top 3 Online Depreciation Calculator To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense